The following are quick hits of editorial analysis from The Foggiest Idea on the local and regional developmental issues that matter. For more, be sure to LIKE TFI on Facebook.

By Richard Murdocco

SMITHTOWN AND HAUPPAUGE SCHOOLS AT ODDS OVER INDUSTRIAL PARK REZONING

The Town of Smithtown and the Hauppauge Union Free School District are legally sparring months after zoning changes were approved that allow apartments to be built within one of the Long Island region’s main industrial hubs.

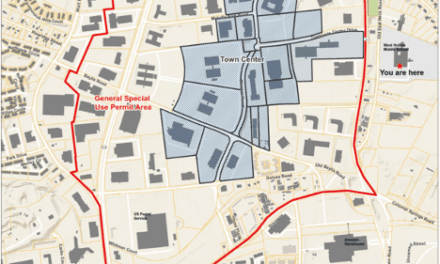

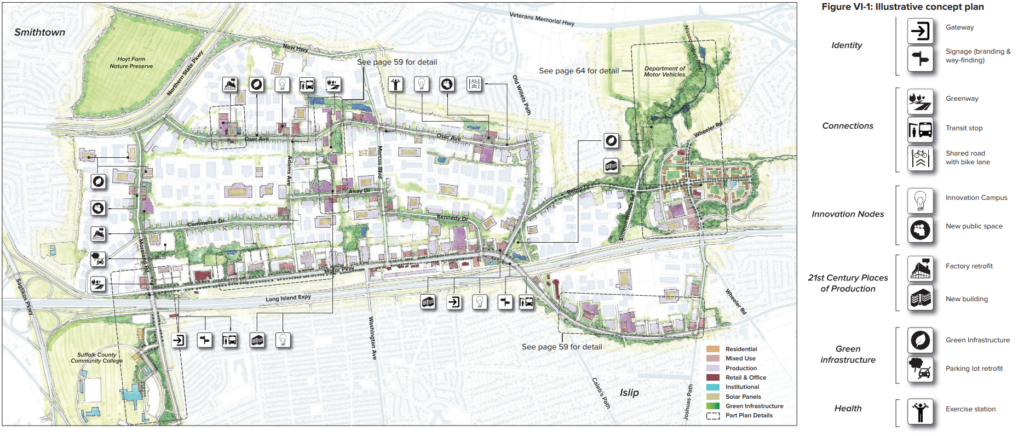

The scuffle started back in August, when Smithtown approved the creation of a zoning overlay district for the Long Island Innovation Park at Hauppauge, a 1,650 acre industrial park that sits in the corner of the Sunken Meadow Parkway and Long Island Expressway. The overlay allows for the first time both residential and mixed-use projects within the industrial area. At the time, the move was condemned by the school district, who expressed concerns about residential projects in the park boosting enrollment in area schools.

In a December filing with the Suffolk County Supreme Court, the school district is claiming that the Town did not do the necessary environmental due-diligence in assessing the long term impacts of the rezoning, and the overlay permissions should be reversed. Countering, Smithtown says the district has no standing to sue, and that residents have misunderstood reports in the media on how the new zoning overlay functions. The municipality is asking the court to dismiss the lawsuit outright.

Pictured: A conceptual rendering of zoning changes that were made within the Long Island Innovation Park at Hauppauge.

Recently, a town spokeswoman told TBR News Media that any new project would have to go through its own dedicated environmental review process, as well as go before the Smithtown’s Planning Board and Board of Zoning Appeals.

When the matter was up for public comment this summer, David Barshay, who has been president of the Hauppauge Board of Education since 2013, argued that the district needs to better understand the rezoning’s impacts on student enrollment. “Give us time to figure out if we can even absorb these kids,” Barshay said during an August hearing on the matter.

The Foggiest Idea reported at the time that the district had asked policymakers to delay public hearings on the subject to give the board of education more time to study the rezoning proposal. The overlay was approved by elected officials shortly after the hearings.

The zoning overlay is already generating buzz in the development community – A $125 million mixed-use building with 335 apartments is being pitched within the industrial park by builders looking to take advantage of the newly flexible zoning codes.

WANT A HOME IN THE ‘BURBS? APPARENTLY, SO DOES EVERYONE ELSE.

With home buyers facing record-low levels of inventory and sellers witnessing ever-rising demand, housing values and levels of market activity have skyrocketed across Long Island.

Recent data from OneKey MLS shows that the median sales price throughout Suffolk County climbed 16.5% to $480,000 compared to last year, while Nassau’s median rose annually by 13% to $606,500. Activity kept pace with prices as the number of closed sales rose 33% in Suffolk and Nassau saw a nearly 35% boost. These figures exclude Long Island’s tony East End areas, which have their own housing market dynamics.

Out east, reports from Douglas Elliman show that housing markets on the Twin Forks remain superheated as the area’s median sale price rose by 40 percent in 2020 and sales volume increased by 37 percent – their highest rate in a decade. The median sale price hit $1,202,500 in 2020, representing a 40 percent increase from 2019. The number of sales for the year rose by 37 percent compared to the year before.

“The East End has, to a large degree, been the beneficiary of the challenges faced in the city,” Jonathan Miller, president and CEO of the Manhattan-based appraisal firm Miller Samuel, and author of the Douglas Elliman report, told The New York Times. “This region is having its day.” Even with the gains, Miller did express caution by noting that the price upticks are less about rising prices in the overall market and more about strong sales activity.

Other experts warned the Times’ Sydney Franklin that the East End’s housing bonanza may not be sustainable in the years ahead.

“The amount of transactions can’t keep pace in 2021 compared to what’s happened in 2020, because the amount of options out there have totally dissipated,” J.B. Andreassi, a broker in the area, said. “There’s really very few options left that are good-quality purchases and investments for people.”

Sustainable or not, the onslaught of market activity has helped inflate the Peconic Bay Community Preservation Fund, a 2% tax on East End real estate sales that typically funds open space and water protection efforts.

According to figures cited in Newsday‘s The Point, the CPF took in a whopping $139.42 million, far surpassing the previous record of $107.69 million that was set back in 2014. Among the five East End towns within Suffolk County that benefit from the CPF, both Southampton and East Hampton raised the most money, with the two localities taking in $80.71 million and $40.94 million respectively.

The 2020 figures reverse the CPF’s recent downward course. During both 2018 and 2019, the fund was taking in less and less each quarter, a reflection of a struggling luxury market on the East End. At the time, both experts and elected officials blamed the decline on the then-new $10,000 cap on the federal deduction for state and local income taxes (SALT). Now, thanks to space-starved and well-heeled city buyers during a global pandemic, those days are a distant memory.

“I never cease to be shocked by these numbers,” New York State Assemblyman Fred Thiele (I-Sag Harbor), a co-writer of the CPF legislation in 1998, told The Point’s Michael Dobie. “As far as I can tell from talking to lawyers and real estate brokers, it’s still a strong market.”

So that makes for at least one silver lining – the chance for more open space and farmland protection, as was as additional investment in water quality projects – during an otherwise difficult year.

-30-