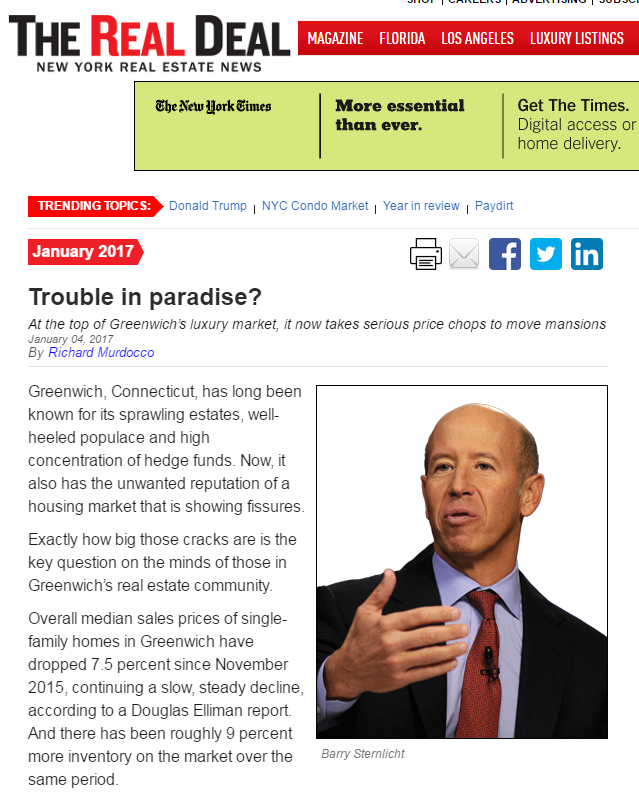

The following story was written for the Real Deal’s special Westchester/Fairfield County edition in January 2017. This piece was featured on the publication’s cover. You can read the original version here.

January 04, 2017

By Richard Murdocco

Greenwich, Connecticut, has long been known for its sprawling estates, well-heeled populace and high concentration of hedge funds. Now, it also has the unwanted reputation of a housing market that is showing fissures.

Exactly how big those cracks are is the key question on the minds of those in Greenwich’s real estate community.

Overall median sales prices of single-family homes in Greenwich have dropped 7.5 percent since November 2015, continuing a slow, steady decline, according to a Douglas Elliman report. And there has been roughly 9 percent more inventory on the market over the same period.

But the most prominent weakness is at the high end of the market. “It’s a tale of two cities” for sellers, said David Haffenreffer, manager of Houlihan Lawrence’s Greenwich office. “As you go up in price, things get weaker.”

The luxury segment — which is the top 10 percent of the market — has seen a sharp decline, with sales prices falling 15.7 percent in the third quarter in Greenwich as compared to last year, according to the Elliman report. Prices per square foot in the upper tier fell to $677, a 7.4-percent drop from 2015. And listing inventory is up more than 32 percent over last year, with 259 active listings at or above the $3.87 million threshold for luxury.

Houlihan Lawrence research found that the higher the price range, the bigger the problems. As of November, there were four homes sold in the $8 million-to-$10 million segment of the market in 2016 — a steep 43 percent year-over-year drop — versus 108 under $1 million, an 11.3 percent increase. Haffenreffer said “the hottest segment is within the zero-to-$2.5 million price range, where there is high demand and inventory is down.”

He went on to say that new construction or almost completely renovated properties are the ones most easily sold and getting the best premium prices: “Buyers want little or nothing to do. The old joke is they want to show up with just their toothbrush,” he said.

These days in Greenwich, even the wealthiest homeowners can find themselves on the wrong side of the tracks when it comes to trying to sell. While brokers say buyers are still interested in estates on Long Island Sound — on the Gold Coast, as it’s known — away from Greenwich’s shore, luxury demand dries up quickly.

42 Mooreland Road

The frustration of at least one would-be seller boiled over in a very public way.

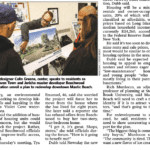

Barry Sternlicht, chairman and chief executive officer of Greenwich-based Starwood Capital Group, put the weakness of the high-end market into national attention when he complained about trying to sell a luxury home in Greenwich. At an asset management conference in September, he declared that Greenwich might be the U.S.’s worst housing market. “You can’t give away a house in Greenwich,” he said.

Sternlicht’s definition of “give away” might not have been literal, but his point was clear. Seven- and eight-figure Greenwich homes — including his own, which is still on the market at $10.9 million after a $1 million cut — are hard to sell. And that is a trend echoing across the New York metropolitan luxury market, as well as other major U.S. cities.

“Right now, the supply of high-end homes is rising, demand is falling, and prices are being cut,” Joshua Steiner, a managing director and financials sector head for Stamford-based investment research firm Hedgeye, said in a November 2016 analysis for Fortune magazine. “It’s not exactly a recipe for success if you’re trying to sell your multi-million-dollar home,” he wrote. “What we’re witnessing in Greenwich right now is a microcosm of what’s going on more broadly.”

440 Round Hill Road

Among homes priced $3 million or more, sales have dropped drastically from last year, with 112 units changing hands from the beginning of this year through November, a roughly 27 percent decline year over year, according to the Greenwich Multiple Listing Service. For purposes of comparison, at the market’s peak in 2007, there were 207 homes priced at $3 million and above sold in that time frame, while in the depths of the Great Recession in 2009, only 68 such homes had sold.

Following Sternlicht’s public takedown of the Greenwich market, Jonathan Miller -— president and CEO of Manhattan-based Miller Samuel Inc., a real estate appraisal and consulting firm that produces Douglas Elliman’s reports — wrote about the reaction to the Starwood CEO’s views. “The brokerage community in Greenwich was appalled and many took the insult personally, at the risk of propping up sellers to unrealistic expectations they have maintained since 2007,” Miller said in his analysis.

“The effectiveness of spinning market conditions to hide actual conditions is a myth. I believe this way of broker thinking actually damages the market by keeping the gap between buyers and sellers artificially wide,” Miller continued. “Greenwich, which relies on Wall Street for the high-end home buyer market, did not see the boom of the past five years that NYC saw.”

In an interview with TRD, Miller said that there is a boom in Greenwich’s entry level-to-$2 million market, but he reiterated his belief that some in the area are “cheerleading for conditions that don’t exist.” He said that as great of a community as Greenwich is, it simply isn’t immune to broader trends. “There’s been a shift in preferences. Almost every housing market in the New York City metro area is soft at the top,” he said.

200 Guards Road

But the Greenwich real estate market still has its cheerleaders. Christine Georgopulo, a managing member of Greenwich Great Estates LLC who also serves on the town’s Economic Advisory Council, said the area’s real estate markets are alive and well.

“While a few vocal people may have overpriced their homes, resulting in a negative response from the market, it does not indicate a luxury market crash by any means,” she said. “The perception of Greenwich needs to come in line with the reality.”

She went on to say that while the market is still adjusting, Greenwich is “a tremendous value compared to other areas,” pointing to taxes that she said are 20 to 30 percent less than in surrounding towns with similar products.

Still, it seems that in some ways, Greenwich may be a thorn in its own side. Georgopulo said that the area’s reputation for wealth and excess can at times be counterproductive to buyers and sellers. “What we’re seeing is a confluence of opportunistic buyers and aggressive sellers, fear of market volatility in an election year, overpriced housing, and perceived barriers of entry into the community,” she said.