The following is a quick hit of reporting and editorial analysis from The Foggiest Idea on the local and regional developmental issues that matter.

Published January 2nd, 2022

By Richard Murdocco

After being propelled to new heights by pandemic-fueled fears and enticingly low mortgage rates, the frenetic suburban housing markets across the New York metropolitan region may finally be showing signs of cooling down.

Jonathan Miller, president and CEO of Manhattan-based Miller Samuel Inc., a real estate appraisal and consulting firm that produces Douglas Elliman’s market reports, most recently found that inventory of single-family homes in the suburbs has fallen sharply from a year earlier.

On Long Island, housing inventory levels have shown a particularly pronounced decline, dropping 22% when compared to last year.

Experts recently noted to the New York Times that this lack of available inventory, paired with still-climbing prices and noticeably less demand from city dwellers to move out to the ‘burbs, all have contributed to lessening the suburban market’s fervor.

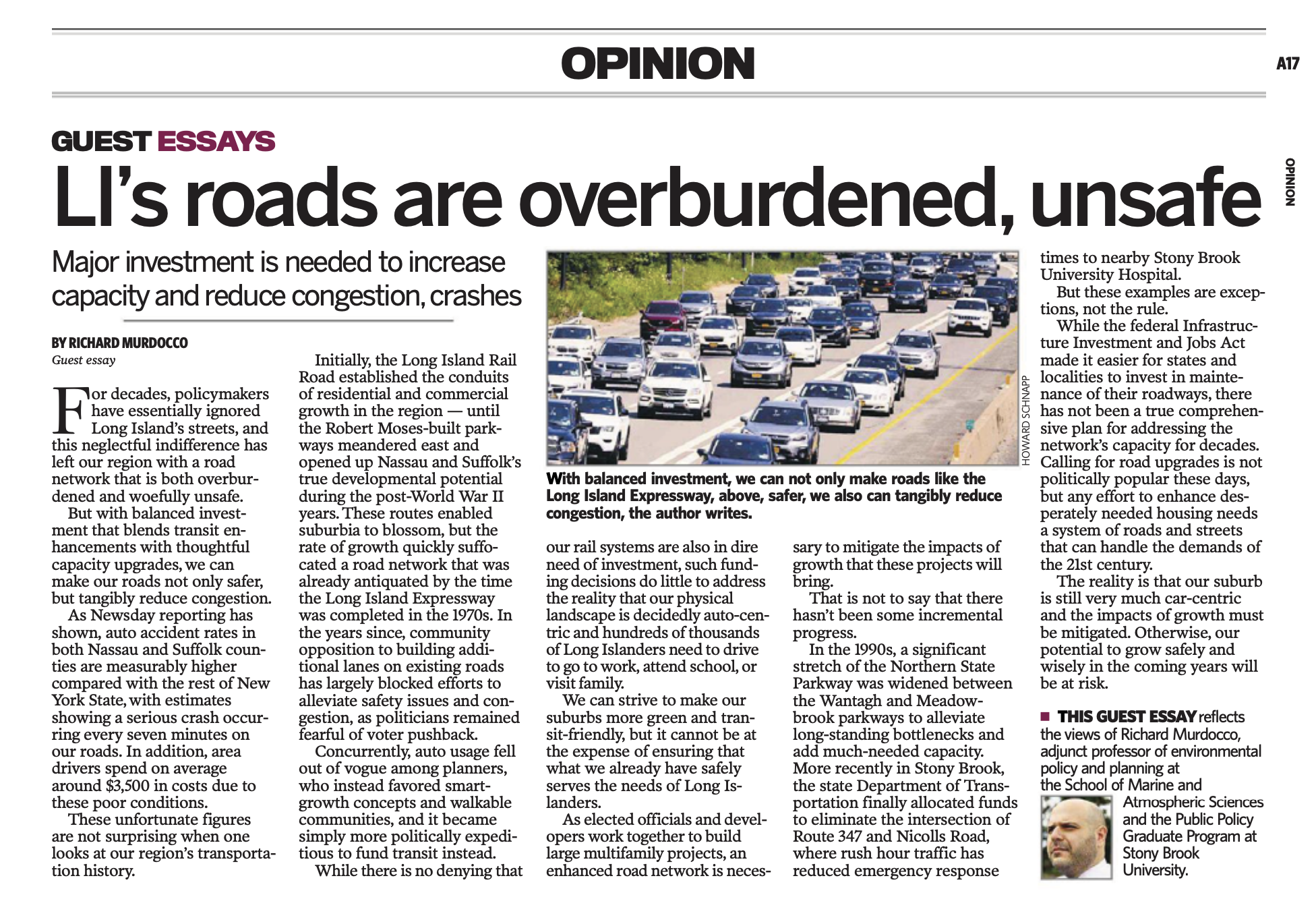

Pictured: A home that is currently under contract in Western Suffolk County. Overall, the available inventory of homes on Long Island has plunged 22% when compared to last year. (Photo Source: Richard Murdocco/The Foggiest Idea)

Homes that buyers were in-fact able to scoop up drove Long Island’s overall median sale price to $585,000, a 17% increase. Miller’s report found that more than half of homes sold throughout the third quarter of 2020 for over the asking price, and rise of median pricing has set yet another record for the sixth straight quarter.

Despite overall pricing gains, real estate agents who spoke to the New York Times noticed that sales activity began to slow later in the year. “The panic buying has subsided, and the crazy bidding wars are less common,” Andy Sachs, a real estate agent with Keller Williams, told the publication.

Even with signs of a slow-down, everything in these strange times is relative.

“As a result of rising sales and falling listing inventory, the pace of the market was the third fastest on record,” Miller’s report noted.