The following was written for the Community Development Corporation’s annual report to NeighborWorks America. It presents a good snapshot of the economic realities that Long Islanders are currently facing, as well as a snapshot of the housing and commercial real estate markets. All sources and references are available upon request.

Preface

Community Development Corporation of Long Island (CDC) works to support the housing and economic aspirations of individuals, families and small businesses through exemplary stewardship of resources entrusted to us. This market analysis is a snapshot of current regional trends that impact CDC’s efforts to fulfill its mission and vision of meeting the needs of people and businesses in order to foster vibrant, equitable and sustainable communities.

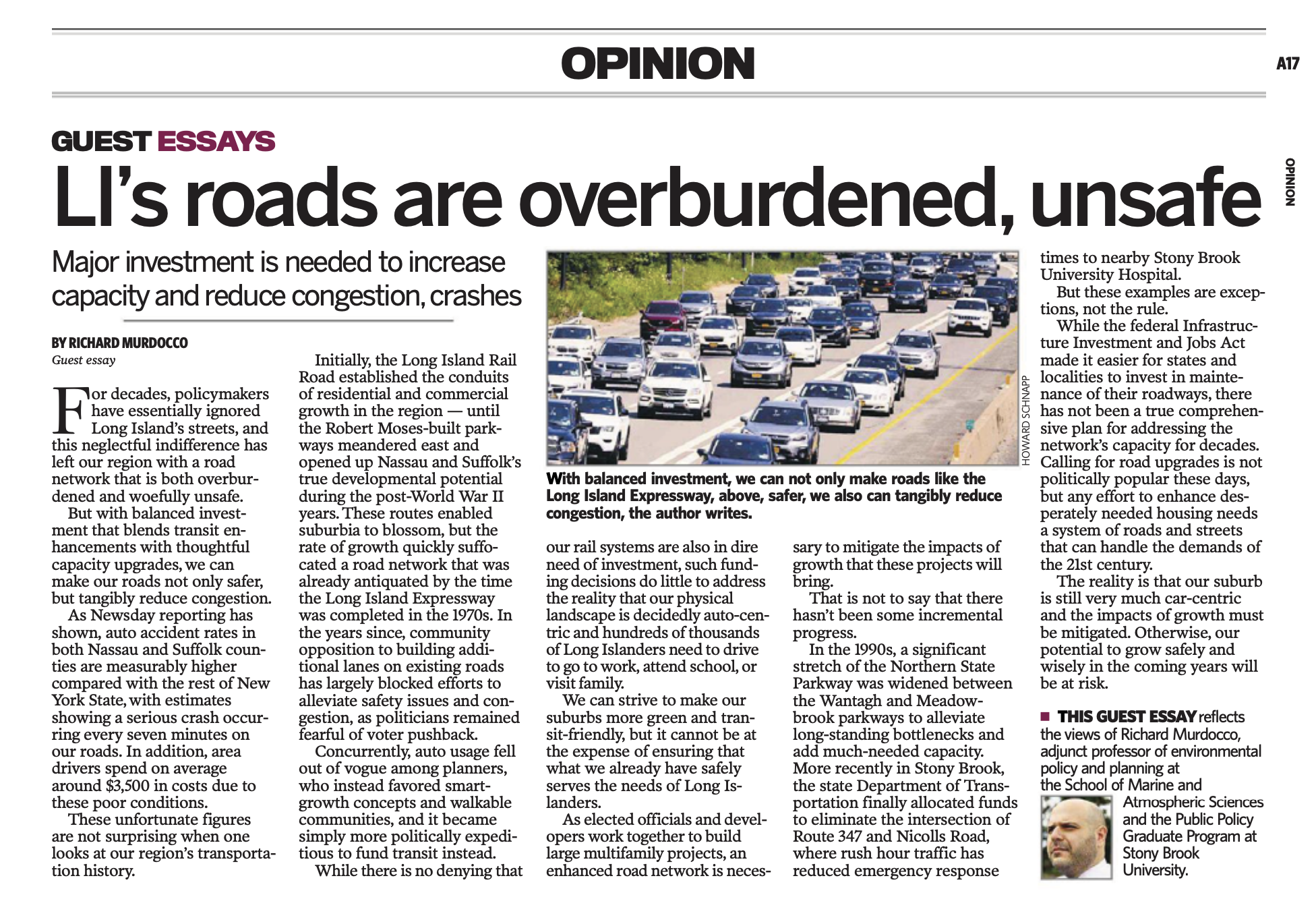

The nation’s economic outlook is stagnant. Consumer confidence waxes and wanes along with the price of gas, but there are signs of recovery. The housing market is slowly rebuilding from the ruins of 2008, while American auto companies are expanding both domestically and globally. On Long Island, the economic picture is bleaker than most areas, due to the increased cost of living, the constraints of being an aging suburb, and the lack of true innovation which brings high paying jobs to the region.

Description of Long Island

Long Island is composed of two counties, Nassau and Suffolk, and is the principal suburban area of New York City. Geographically, Long Island spans an area of 1,377 square miles and is home to 2.7 million people. If it were a state, Long Island would rank 12thin population and first in population density. This region contains more than 980,000 households, with most residential units being composed of single family homes constructed between the years 1950-1980. Long Islanders are still facing the realities of the recession: joblessness or under-employment, deflated home values and a general feeling of malaise. Moving forward, Long Island’s greatest challenge is diversifying its economy, preserving its environmental resources and creating social equity.

Long Island’s housing market is uniquely constrained compared to other suburban counties in New York State due to the limited amount of open space available for new housing developments, high property taxes and high cost of living. These factors contribute to the unique set of challenges that Long Island’s homeowners face. It is important to note that these factors were already in place well before the recent recession hit- the current economic climate only exacerbates the impacts of these constraints. A recent New York Times Editorial painted a bleak picture of the struggles of Long Island’s suburban homeowners:

It is possible to see this struggle just beyond New York City in a quintessentially suburban place, Long Island. There have long been pockets of poverty there, created by race and income segregation. But it is not just in pockets anymore. These days the struggle has metastasized: foreclosed homes are just as empty in the better-off subdivisions, with the same weed-choked yards, plywood windows and mold-streaked clapboard siding. Long Island’s two counties, Nassau and Suffolk, have the second- and third-highest foreclosure rates in New York State, behind Queens. Debt counselors across the island juggle a mix of clients: immigrant families undone by predatory lenders and middle-class professionals impoverished by illness, layoffs or credit-card bills.

Source: Struggling in the Suburbs New York Times, July 7th,2012

Housing-Related Issues

Foreclosure and the Erosion of the American Dream

Long Island was once a crucible of innovation, setting the national template for post-war suburban growth, aerospace engineering and at the forefront of environmental policy. Along the corridors of Robert Moses’ elaborate parkway system, subdivisions rose from the potato and cabbage fields, with each crop of development providing affordable shelter and good schools. Over the decades, what once was attainable to a middle-income family is growing further and further out of reach.

Foreclosure rates are still rising across Long Island, despite these indications of improvement in the national housing market. According to Dr. Pearl M. Kamer, the Long Island Association’s Chief Economist and expert on Long Island’s economy, pending home sales on the national level are the strongest they’ve been since 2006 at the peak of the housing bubble. (Source: LIA Monthly Economic Report July 2012).

Despite this national improvement, Long Island still has some of the highest county foreclosure numbers in New York State. Recently, Newsday reported (5/30/12) that in March 2012, 6.7% of homes with outstanding mortgage loans in Nassau and Suffolk were in foreclosure, an increase of almost 1 percentage point compared with March 2011. This is nearly double the national rate of 3.4 percent.

Statewide, Long Island has some of the largest clusters of population that were adversely impacted by the recession. According to Newsday,RealtyTrac reported that the number of new foreclosure filings spiked by 50 percent in Suffolk County and 34 percent in Nassau County in May of 2012, compared with the same period in 2011 (Source: Foreclosures Up on Long Island, Report Says, Maura McDermott, Newsday 6.27.12). Suffolk County’s foreclosure rate of 7.5 percent was the second highest in New York State; Nassau County, with a rate of 5.6 percent, is ranked 11th in the state. Newsday has also reported) that in the fourth quarter of 2011, 5.3% of homes on Long Island had mortgages that were underwater.

In June of 2012, RealtyTrac, a foreclosure listing firm, stated that there were 391 new notifications of pending foreclosure in Nassau County and 178 in Suffolk County. This number is down compared to numbers taken in June of 2011, when there were 428 in Nassau and 292 in Suffolk. Currently, foreclosures are affecting one in 1,162 homes in Nassau and one in 2,317 in Suffolk (Source: Help for Struggling Borrowers, Marcelle S. Fischler, New York Times).

Case Study: Wyandanch

According to the 2005-2009 U. S. Census Bureau American Community Survey, Wyandanch alone has an unemployment rate of 9%. This percentage is well above the Island’s average unemployment rate of 7.8% (Source: LIBN, April 2012). Further, 18.5% of the hamlet’s residents are living below the poverty line. These are the highest rates on Long Island, and all of these statistics serve as troubling indicators of economic distress.

Currently, Suffolk County, partnered with the Town of Babylon, is working on revitalizing the community via the development of nodal downtown area around the Wyandanch Train station, and installing crucial wastewater infrastructure that was needed to support future expansion and growth. Once the appropriate infrastructure is in place, policies can be enacted to help the hamlet prosper.

The Challenges of Building Multi-Family Housing and Rental Units

The severity of the toll the recession had on Long Island’s building industry is evident in the number of building permits issued by local municipalities. Before the recession, Nassau and Suffolk Counties, on average, were approving 4,979 residential building permits a year, almost all for single-family homes. (Source: Suffolk County Dept. of Planning) After the recession, permit approvals dropped down on average to one fifth pre-recession levels. In 2011, 1,102 residential building permits were approved, representing a 78% decline of residential construction activity on the Island.

According to data compiled from the Suffolk County Planning Department, sourced Multi-Family housing starts on Long Island have always been scarce over the years. For example, during 2005 (the peak year of housing construction on LI), 6,618 permits were approved. Of these approvals, 5,438 were single family homes, with the remainder 1,180 constituting Multi-Family construction. The majority of these units were built in the Town of Hempstead. Only 18% of housing units constructed were Multi-Family units, and this is during the peak. In 2010, there were approximately 1,494 new housing units approved, of which 1,310 were single-family homes. A mere 184 of these new units were approved as Multi-Family developments. Despite indications that the market is demanding denser, multi-family developments in downtown areas with walkable amenities and near transit hubs, municipalities are continuing to perpetuate the old models of growth by approving new single family homes, thus adding to the dearth of foreclosed and vacant properties already available. As of June 2012, there were 21,213 units available on the market in both Nassau and Suffolk Counties (Source: Multiple Listing Service of Long Island Real Estate Market Report for Nassau and Suffolk Counties).

According to the Long Island Index, the Nassau and Suffolk region continues to have the lowest share of rental housing units across the region. In 2010, one out of every five occupied units was occupied by renters either as single-family units rented out by the owners or apartments in multi-family buildings. This ration represents the same share Long Island had in 2000. In other New York suburbs, as well as nationwide, the ratio was one out of three (Source: The Long Island Index 2012 Report)

The challenge for Long Island moving forward is addressing the market’s demand for dense, affordable housing. If the obstacles presented by strict Euclidian zoning can be overcome, this would enable municipalities to take steps in reconciling this demand with policies that ease restrictions in areas where such growth makes sense. Often, affordable housing is not built due to lack of effort on the part of government or non profits, but by neighborhood opposition. These NIMBY sentiments often are sourced from an innate fear of density, traffic impacts and general worry over property values. If more affordable housing is to be constructed, there must be a cultural shift in hamlets across the region. Affordable developments must blend in seamlessly with existing neighborhoods, and must maintain the same levels of density to minimize NIMBY opposition. Once these goals are accomplished, only then policymakers can take steps in approving more MF building permits and attack the issue of affordable housing head on.

Financial Burden: The High Cost of Living in Nassau and Suffolk

The strangling costs of homeownership across Nassau and Suffolk are hampering Long Island’s sustainable growth. According to the Long Island Index (Source: The 2012 Long Island Index Report), more than one third of Long Island households spent 35% or more of their incomes on housing cost in 2010. This high cost burden, paired with the statistical realities of the post baby-boom years (Rethinking the Brain Drain Census Shows Young Adult Population Grows Slightly on Long Island, September 2011, Long Island Regional Planning Board, Seth Forman) is driving out the younger population to more affordable regions of the country. The LI Index states young Long Island householders aged between 25 and 34 had the highest housing cost burdens compared to the same age group living in other parts of the region. Two out five young Long Islanders spent more than 35% of their incomes on housing. The challenge is not getting these young people to come back to the region, but rather, providing affordable housing options when they inevitably return.

Both household incomes and home values went down on Long Island in 2010. Median home value decreased a slightly more than levels of median household income, resulting in a slightly smaller ratio of home value to household income. Compared to the peak at 5.9 in 2006 (the peak of the housing bubble), the ratio had dropped by 15% to just below 5. But it is still much higher than the level in 2000 and almost doubles what financial experts believe is a reasonable level of 2.5.

There is some good news however. For the first time in over a decade, the median rent on Long Island dropped for the first time in 2010 and went to lower than what it was in 2008. The drop can be attributed to a shrinking market of the rental units that cost $1,500 or more a month. Besides slightly lower rents, rentals do not provide much relief regarding the burden of costs due to the fact that more than 40% of rental units on Long Island cost $1,500 or more a month, almost doubling the share in other New York suburbs.

Increasing Unemployment, Slow Job Growth: Treading Water

According to Pearl Kamer, the chief economist for the Long Island Association, Long Island’s June unemployment rate jumped to 7.7% from 6.7% a year ago because more “discouraged” workers jumped back into the labor market in hopes of finding a job. Kamer makes an important distinction that the rise in the unemployment rate does not indicate further labor market deterioration, but rather it reflects the fact that discouraged workers are again counted as unemployed because they resumed their search for work (Source: LIA Monthly Economic Report: July 2012). According to Newsday, Long Island had 115,600 unemployed residents in June, up 11,100 from a year ago. Logically, New York State’s unemployment rate increased to 9.1 percent from 8.1 percent the year before. Nationally, the unemployment rate is at 8.4 percent, which is down from 9.3 percent a year earlier (Source: Island’s Unemployment Hits 7.7 Percent in June, Carrie Mason-Draffan, Sarah Tan, Newsday 7.24.12). It is important to note that these numbers and percentage do not reflect the segments of the population that are under-employed. In the prior twelve months ending in May, the region gained 9,100 payroll jobs. Kamer found that job growth was concentrated in professional business, educational and health services. Since the departure of the aerospace industry, Long Island’s economy has been limping along. Only recently is the region’s labor force beginning to once again diversify and grow. Professions in the health services industry are rapidly expanding on Long Island, being fueled by the expansion of North Shore LIJ, Stony Brook Hospital both serving the aging baby boomer population. This trend is projected to continue as the aging population steadily increases.

While in this economy any job growth is positive, Long Island is seeing the expansion of lower wage retail positions. High paying commercial jobs are being created, while manufacturing is steadily declining. Local governments across the region are actively rezoning their industrial land for either commercial or residential uses.

Kamer states that the major industries on Long Island are retail trade, accounting for 13.6% of all retail establishments, professional and technical services for 13.3% of the total, and construction, which accounts for 11.5% of the total. Health care ranks a close fourth, accounting for 10.9% of all business establishments. Manufacturing businesses account for only 3.4% of all private‐sector businesses. The remaining industries are diverse, yet small, including agriculture, food and financial services.

Recently, Newsday reported that office vacancies on Long Island rose to 8.5 percent during the second quarter of 2012, representing a slight increase from the first three months of the year. Although the vacancy rate grew since last quarter, it’s down from the last half of 2011, when the level of empty office spaces was about 9 percent. These numbers are still better than the national office vacancy rate of 12.1 (Source: Long Island Office Vacancies Rose Last Quarter, Lisa Du, Newsday 7/13/12). These trends indicate that Long Island’s commercial market is slowly growing, but still facing harsh competition in the always contentious tri-state area.

Long Island in the Next Decade: The Need for Affordable Housing

The provision of affordable housing, reversing the rise of unemployment and lowering the cost of living in Nassau and Suffolk Counties presents a multitude of large-scale challenges in the next decade. These challenges cannot be overcome on a local level, but instead, should be tackled using a comprehensive approach that is regional in scale.

Currently, there are 124 school districts, over 54 municipal water suppliers and 97 incorporated villages on Long Island (Suffolk has 33 and Nassau has 64). These districts, villages and countless other jurisdictions impede the creation of regional policies. A local issue that is especially impacted by political and social division created by these jurisdictional divisions is the provision of affordable housing. It was estimated by planners that Long Island needed 26,597 to 41,429 affordable housing units between 2005 and 2030. (Source: Long Island Comprehensive Regional Plan, Dr. Koppelman, Seth Forman, LIRPB 2005) While these numbers may be slightly adjusted to account for the recession, this large need for affordable housing is still an issue that has hung over the Island for decades. As Long Island’s economy further strays from manufacturing, supporting labor will need affordable places to live, regardless of economic conditions. If a fair share approach to the allocation of affordable housing developments is given to each town and village, meeting the regions housing needs will be much more realistic.

Conclusion

Nationally, economic losses and gains are essentially cancelling each other out, resulting in a stagnant economic picture. Locally, Nassau and Suffolk Counties are faced with not only increased unemployment levels, but slowing growth rates in the private sectors that fueled Long Island’s economic booms in the past. Moving forward, the pursuit of diversification is necessary, both of the industries where Long Islanders work, and in the housing options. Unless Long Island tackles these issues head on, the recovery effort will be more difficult than it already is.